This price is intended to deal with HUD’s cost of performing web page inspections for the duration of its initial evaluate of the appliance and post-closing to watch construction progress. This rate is collected at closing.

The Operating money escrow is completely funded at closing and posted with Lender with income or letter of credit history (in variety appropriate to HUD). If funded in hard cash, this sort of resources are typically held in escrow because of the Lender in an interest-bearing account with a suitable economic establishment.

As loans can vary with regard to curiosity-level construction, transaction fees, late penalties and other things, a standardized computation such as the APR delivers borrowers having a base-line number they can easily compare to costs billed by other lenders. Since FinnFox would not supply loans by itself, it is necessary to Get in touch with the lender you will be related with directly to receive the specific facts within your loan agreement.

Performing CAPITAL ESCROW. HUD calls for that the FHA Lender obtain a Doing the job money escrow on new construction and considerable rehabilitation programs to supply funding for taxes, insurance policy, and fascination in the event of design delays, together with other suitable costs not included in the loan funds important to complete the task.

At Janover, we offer a wide range of solutions tailored to your unique needs. From professional residence loans and LP management to enterprise loans and solutions for lenders, we are below to assist you to triumph. Learn more about Janover →

The Performing cash escrow on sub-rehab more info purposes is only two% from the loan amount of money, with the construction contingency becoming funded outside of loan proceeds.

With our streamlined system, we provide customized loan solutions, versatile repayment options, plus a community of dependable lenders to match your requirements.

The credit rating improvement afforded through the FHA / HUD loan insurance application allows for the sort of construction financing that's pretty much unmet available in the market. Critical qualities of the 232 loan application contain:

Davis-Bacon wage rates are required on new construction and sizeable rehabilitation transactions.

Capital Improvements and Repairs: Loan proceeds may additionally be utilized for essential money enhancements, repairs, and upkeep to guarantee the power’s extensive-time period viability.

As being the FHA-Accepted Lender is the key player in the procedure, we inspire probable borrowers to Make contact with a lender as early in the method as possible. The lender will stroll you thru the procedure - from initial discussions to underwriting and submittal of the appliance to your closing from the loan.

Interests premiums are determined by market place circumstances at enough time of rate lock. The rate is fastened for the full phrase with the loan.

2019 - Part 232: System Overview and Asset Administration Document Updates This webinar features an outline about programs made available by means of ORCF and detailed data associated with variations inside the demanded HUD-revealed files for use by borrowers and operators in doing asset administration functions within their amenities.

For brand new construction purposes, the Functioning capital escrow equals 4% of the loan total, fifty percent of which is allocated for a development contingency.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Daryl Hannah Then & Now!

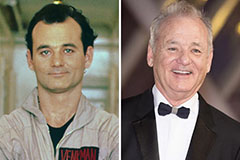

Daryl Hannah Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!